September 9, 2024

NFP Workforce Planning and Salary Snapshot 2024

CATEGORIES

DATE

September 9, 2024

SHARE

Welcome to NGO Recruitment’s latest Workforce Planning and Salary Snapshot FY2024/2025.

As Australia’s largest NFP sector executive search and recruitment partner, we are uniquely placed to track hiring intentions and remuneration trends across the sector. Our annual survey provides invaluable insights into current NFP employment trends and recruitment challenges.

This year’s findings reflect the current economic climate, with high inflation, interest rates and cost of living impacting hiring intentions and salary expectations. According to our survey, over two-thirds of potential new hires now expect higher salaries due to economic pressures, and securing better pay elsewhere remains the number one reason why people are leaving NFP organisations.

While NFPs are finding it marginally easier to recruit this new financial year compared to immediately after the pandemic, retaining talent is proving harder. We are therefore partnering with our clients to revisit workforce planning, attraction and retention strategies to find innovative ways to work within budget constraints.

At the end of this report, you will find our latest salary snapshot based on our internal recruitment data and extensive market research, with average figures exclusive of superannuation, bonuses and benefits for most roles within the sector. We have seen an average 3-6% salary increase in the last 18 months depending on role and size of organisation, and expect further increases across the board in the next 12 months.

A sincere thank you to everyone who participated in our survey. We hope you find the research included within this report of value and we welcome any feedback.

Richard Green | Director | NGO Recruitment

OVERVIEW

In July 2024, NGO Recruitment surveyed 100 Australian NFPs to assess hiring and remuneration intentions over the next 12 months, as well as current recruitment challenges and shifts in workplace culture.

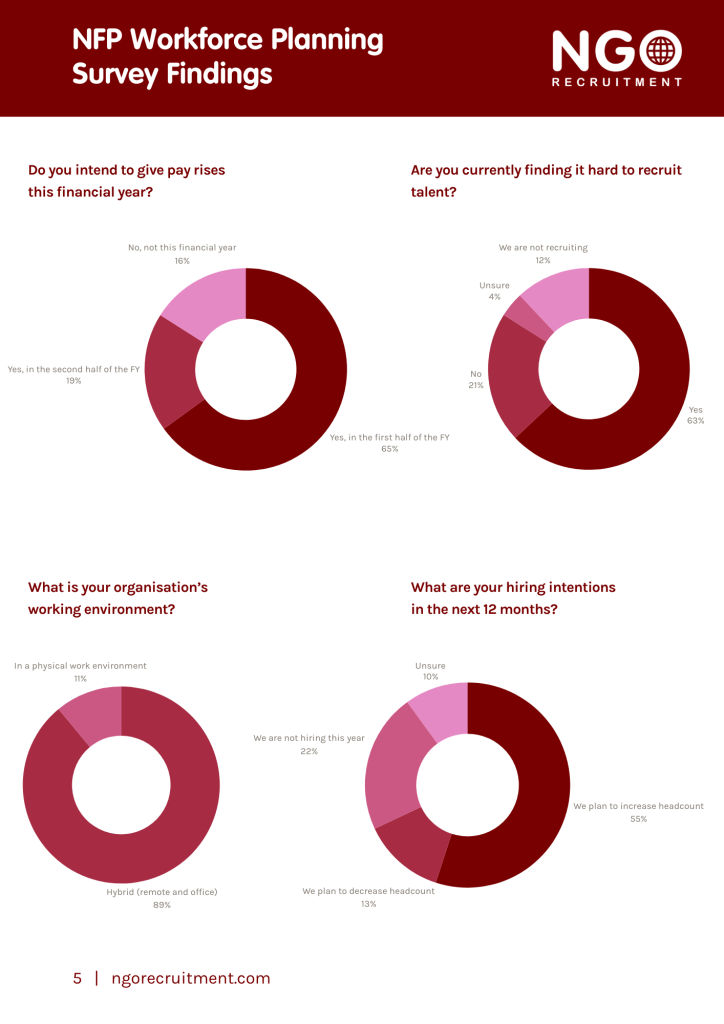

At a high level, the optimism reflected in our previous comprehensive survey in 2022 has given way to realism, with NFPs adopting a more cautious approach to workforce planning post-pandemic. Workforce demand has stabilised, with 55% of NFPs surveyed intending to hire this financial year, compared to 66% in 2022. 22% do not plan to increase headcount, and 13% of those surveyed intend to decrease headcount, up from only 4% two years ago. 11% are unsure.

Despite this uncertainty, NFPs are finding it easier to recruit than two years ago, when severe talent shortages and record-low unemployment posed significant challenges. With our borders open and short-term visas readily available, NFPs surveyed reveal being inundated with low-quality or unsuitable applications for junior roles, making it difficult to identify qualified candidates.

Conversely, there are often no applicants for highly skilled, senior or technical roles. Skills shortages in these areas remain a considerable challenge for many internal teams, who the partner with external recruitment agencies for their depth and breadth of search expertise.

Even though our survey found that it is marginally easier to recruit in 2024, interestingly, almost half of NFPs surveyed find it harder to retain talent than two years ago. Respondents to our survey cited new generational demands from younger more progressive generations as a key issue, but the overwhelming reason why people are leaving is for more competitive remuneration elsewhere.

SALARIES

According to our survey, 84% of NFPs intend to raise salaries this year, a drop from 91% immediately after the pandemic. Among those surveyed, 42% consistently give annual pay raises in line with enterprise agreement changes, while 28% will raise salaries this year mainly due to inflationary pressures and the increased cost of living.

Notably, as mentioned above, our survey found the number one reason people leave organisations is for better pay elsewhere. When we asked respondents whether potential new hires now expect higher salaries due to inflation and the cost of living, 66% said yes.

Due to budget restraints and uncertainty around fundraising revenue, NFPs are already adopting more creative workforce planning strategies to meet salary expectations during the hiring process. Our survey found that 48% negotiate additional benefits to balance salary demands, 20% consider more junior candidates, 17% offer part-time hours to candidates, 4% hire fewer people, and 11% focus on other areas.

Additional benefits include options for creative workplace flexibility, increased annual leave, special leave or study leave days, and even four-day work weeks which have proven highly productive.

Despite the effectiveness of offering competitive salaries, NFP boards and CEOs are still relying heavily on workplace flexibility and mission-based reputation as key attraction strategies over higher-than-average remuneration. For many NFPs, there needs to be a shift in mindset to accept the need to adjust salaries to these inflationary pressures where possible, especially when competing against organisations with the same reputation and appeal.

HYBRID WORKING

Our 2022 survey confirmed a significant shift towards hybrid and remote working within the sector: 60% of respondents said they were working in a more hybrid manner, with 31% working predominantly remotely, positively impacting productivity. In 2024, 89% of those surveyed now work in a hybrid manner, with 0% working predominantly remotely. 11% of respondents, including frontline staff, are still required to work in a physical workspace. 78% of those surveyed said they had set work hours but could be flexible when necessary.

Hybrid working is evidently now the norm in the NFP sector, providing well-acknowledged productivity and work-life balance benefits. Workplace flexibility is non-negotiable for most people and continues to be a major draw for talent and a key retention strategy, despite some organisations pushing for a mandatory return to the office five days a week.

TOP ROLES IN DEMAND

Of the top roles most in demand this financial year, 36% of NFPs surveyed stated fundraising, marketing, communications and events teams are their top priorities. 33% are focusing primarily on program and project delivery roles, and 31% are recruiting counselling, casework and frontline roles.

OUTLOOK

As inflationary pressures ease and potential interest rate cuts are on the horizon, market conditions are expected to remain steady for the next 12 months. NFPs need to be open to new recruitment approaches and strategic in retaining and attracting the best people for their organisation. This includes remaining agile, staying updated on salary expectations and embracing workplace trends, especially with regard to younger generations.

The challenge of hiring highly technical people for the sector will persist regardless of market conditions. NFPs not using a search agency need to ensure that HR and talent acquisition teams spend enough time actively searching for candidates rather than relying solely on those who apply through job boards. Salaries must be adjusted according to inflationary pressures and increased appropriately to retain and secure the best talent.

Feel free to download the full report and please do not hesitate to contact us if you have further questions or feedback.

LOREM IPSUM HEADING

This is paragraph text. Click it or hit the Manage Text button to change the font, color, size, format, and more. To set up site-wide paragraph and title styles, go to Site Theme.